Annual Report on the activities of the Audit Committee

Introduction

The Audit Committee (hereafter the "Committee") is pleased, through the present report, to inform the Annual General Meeting of Shareholders on how the Committee has discharged its responsibilities during very demanding and challenging times for one more year.

This year's report provides information on the Committees activities in 2021, as well as the main points on which its discussions and work focused. In addition to the main areas of discussion, within the scope of its responsibilities presented below, the Committee addressed important issues of the Company as these emerged from the Management's periodic updates to the Committee during the year.

The Committee believes that continuous enhancement of our internal control environment continues to be key to the Company’s sustainability.

In 2022, the Committee will focus on the most important issues and potential risks within its responsibilities, while it will continue to monitor the potential effects of the

The purpose of the Committee and its key responsibilities

The Committee has been established to assist the Board of Directors (the "Board") in fulfilling its oversight responsibilities regarding audit procedures that ensure compliance with the legal and regulatory framework regarding:

(a) financial information;

(b) the System of Internal Controls, including the Internal Audit Division, the Risk Management Function and the Regulatory Compliance Function; and

(c) supervision of the (external) statutory audit of the Company's individual and consolidated financial statements.

While all members of the Board individually and collectively have a duty to act in the interests of the Company, the Committee has a particular role, acting independently from the executive Board Members, to ensure that the interests of shareholders are properly protected in relation to financial reporting and internal control and risk management systems. However, the Board has overall responsibility for the Company's approach to risk management and the system of internal controls.

The Committee reports to the Board on how it discharges its responsibilities and makes recommendations to the Board. A full list of responsibilities is provided in the Committee’s terms of reference which, following the introduction of Law 4706/2020 "Corporate Governance of societes anonymes, modern capital market, implementation of the Directive (EU) 2017/828 of the European Parliament and the Council, measures on the application of the Regulation (EU) 2017/1131 and other provisions", has been revisited by also taking into account the provisions of the United Kingdom Corporate Governance Code — 2018, and of the FRC Guidance on Audit Committees 2016. The Committee’s Terms of Reference, which is approved by the Board of Directors, is available

The Committee shall report to the Board, quarterly or whenever deemed appropriate, on the Committee's work, including indicatively:

- the significant, critical and substantive issues concerning the preparation of the financial reports and how these issues were addressed;

- its assessment of the effectiveness of the statutory audit process and its recommendation on the appointment, reappointment or removal of the Statutory Auditor;

- any issues on which the Board has requested the Committee's opinion;

- the outcome of the statutory audit and an explanation of how the statutory audit contributed to the integrity of financial reporting, and what the role of the Committee was in that process; and

- the reports that the Internal Audit Director submits to the Committee, with regards to the activities of the Internal Audit Division.

In summary the main responsibilities of the Committee include oversight responsibilities on the audit procedures that ensure compliance with the legal and regulatory framework regarding:

The members of the Committee have stated that they accept their responsibilities and duties and that they will perform their activities in accordance with the applicable Terms of Reference of the Committee, the Internal Regulation Code of the Company, and the law.

Composition of the Committee, skills and experience

The Committee is a committee of the Board of Directors and consists of at least three (3) members, who in their entirety are independent non-executive members of the Board. The Committee members shall be appointed by the Board following the recommendation of the Company's Remuneration and Nomination Committee. The Committee Chair shall be appointed by the Committee members. The Chair of the Board cannot be a member of the Committee.

According to the Terms of Reference of the Committee, the tenure of office of its members is similar to the term of office of the Board, which is four years, unless otherwise decided by the General Meeting of the Shareholders or by delegation by it to the Board. The tenure of office of this Committee shall expire on 07.06.2022 (automatically extended until the first ordinary general meeting, after the end of the tenure of the Board).

Composition / Tenure of the Committee

The following table depicts the composition of the Committee during 2021, the tenure of its members as well as relevant notes / clarifications:

| Member | Title | Duration |

|---|---|---|

| Alexios Pilavios | Chair | 07.06.2018 — 07.06.2022 |

| Konstantina Mavraki | Member | 02.02.2021 — 07.06.2022 |

| Anthony Bartzokas | Member | 15.06.2021 — 07.06.2022 |

| Ioannis Petrides | Member | 07.06.2018 — |

| Constantine Cotsilinis | Member | 07.06.2018 — |

Attorney Mrs Vassiliki Prantzou is the Committee’s Secretary. The Corporate Secretary cooperates with the Secretary of the Committee and assists the Committee within the framework of her responsibilities.

The members of the Committee have competencies related to the sectors in which the Company operates, as they have sufficient knowledge in the field of industrial products and services, in auditing or accounting and experience in the areas of Corporate Governance and Internal Control Systems.

Detailed curriculum vitae of the members of the Committee are attached to this Report.

Finally, the Committee has at its disposal the necessary resources to enable it to obtain the assistance of external consultants, if required. In 2021, the Committee was provided with advisory services by Mr. Cotsilinis, an independent advisor, on accounting and auditing issues, as well as by Deloitte on organizational matters of the Committee in compliance with the legislative and regulatory framework.

Committee Meetings and Operation

The Committee meets at regular intervals, at least four (4) times per year, and holds extraordinary meetings when required. The Committee Chair discusses with the Board on the work of the Committee at at every scheduled Board meeting, according to the annual meeting schedule/calendar.

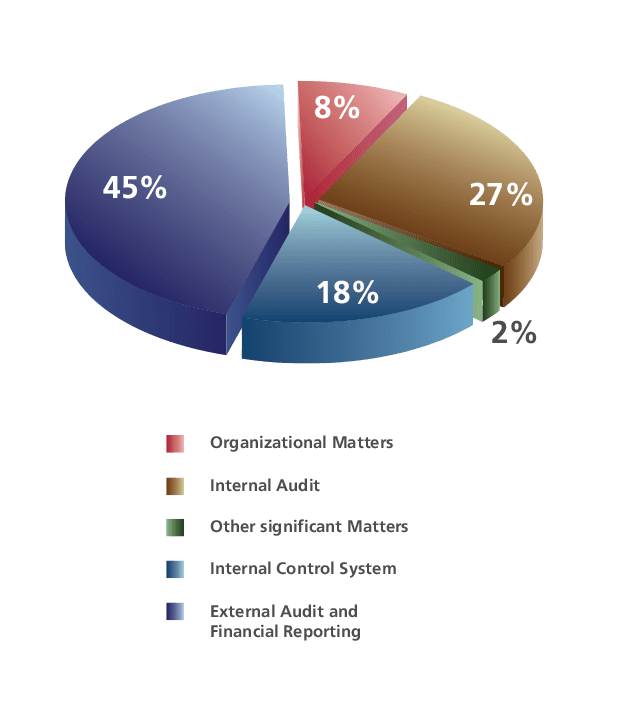

For 2021, the Committee met frequently (16 times in total) and discussed all the topics falling under the areas of its responsibilities, with its main focus on: a) External Audit and Financial Reporting process, b) Internal Audit, c) Internal Control System, d) Organisational matters, e) Other topics relevant to the mandate of the Committee. All the Committee’s decisions were unanimous.

All members of the Committee attended all the meetings for 2021. The meetings of the Committee that concern the approval of the financial statements were attended by all the members of the Committee, as well as by the advisor, Mr. Cotsilinis, who is independent to the Company, and has sufficient knowledge and experience in auditing or accounting.

In addition to the members of the Committee, the Secretary and the Corporate Secretary participate in the meetings when they are not the same person. It is at the discretion of the Committee to invite, whenever deemed appropriate, other members of the Board, or other key persons from inside and outside the Company, to inform it and / or attend a specific meeting or specific items of the agenda. The Chief Financial Officer (CFO), the Treasury General Manager, the Internal Audit Director, the Compliance Director, the Non-financial enterprise risk Manager as well as the statutory auditor or audit firm are invited regularly to the Committee meetings, at the Committee Chair's initiative.

Financial Reporting

Publication of non-audited financial figures and other key information — "Flash Notes"

The Finance Division presented to the Committee the preliminary financial results which were published subsequently by the Company in the form of a "Flash Note", for the financial year ended 31 December 2020, as well as for the period from 01 January 2021 to 30 June 2021 respectively. The aforementioned "Flash Notes" referred to non-audited financial figures and estimates of the Management and forecasts relating to financial data or other events of the above periods. It is noted, however, that the external auditor carried out specific pre-agreed procedures on the "Flash Notes", for the purpose of issuing "Comfort Letter" to the Company's Management. In the "Comfort Letter" of the external auditors, no disagreements were expressed with regards to the data reported through the "Flash Notes". The Committee did not identify any gaps or deviations in the information and safeguards provided to it and recommended to the Board the approval of the publication of the "Flash Notes". Finally, the Committee reviewed the relevant press releases on the "Flash Notes"'.

Financial Statements 2021

In February 2022, the Committee was informed by the Finance Division about the Company's Financial Statements, both at company and at consolidated level, which were prepared in accordance with the IFRS for the year ended 31 December 2021. The Committee was also informed regarding the main accounting assumptions the Company adopted for preparing the Financial Statements which did not differ from those adopted by the Company in 2020, and regarding the key issues the Finance Division considered while preparing these Statements. The Committee was informed that the new or amended IFRS, that were firstly applied in 2021, did not have any significant impact to the Company.

The Committee discussed with the external auditor (Grant Thornton) and the Finance Division the key audit matters during the audit of the Company's annual financial statements for the financial year ended 31.December 2021. The Committee drafted an explanatory report for the Board of Directors and recommended that the Board approves the Financial Statements. In this report, the Committee explained to the Board how the mandatory audit contributed to the integrity of financial reporting and what the role of the Committee was in this process. In this context, the Committee evaluated and concluded that the annual financial report, along with the annual financial statements and the annual management report of the Company, reflect in a true, fair, balanced and understandable manner the evolution, performance and position of the Company, as well as of the companies included in the consolidation, and provide the required information to the shareholders. The Committee also informed the Board that the external auditors have contributed substantially to the integrity of the Financial Statements with their experience and independent assurance that the financial statements reasonably present, in all material aspects, the financial position of the Company and the Group as at 31st December 2021, their financial performance and their cash flow for the year ended on that date.

Financial Results 3rd quarter 2021

The Finance Division informed the Committee on the financial results of 3rd quarter 2021 and brought to its attention the relevant draft announcement to the investors. The Committee, after receiving assurance on the correctness and accuracy of the information that will be made public, expressed its satisfaction for the Company’s progress.

Semi-Annual Financial Results 2021

The Finance Division informed the Committee on the semi-annual financial results of 2021 and no gaps or deviations were identified in the assurance provided on the correctness and accuracy of the information. The Committee drafted an explanatory report on the review of the Company's half-yearly individual and consolidated financial statements to the Board.

Financial Results 1st quarter 2021

The Finance Division informed the Committee on the financial results of 1st quarter 2021 and brought to its attention the draft relevant announcement to the investors. The Committee, after receiving assurance on the correctness and accuracy of the information that will be made public, expressed its satisfaction for the Company’s progress.

External (Statutory) Auditors

Appointment of the external auditors

The Committee has primary responsibility for the appointment of the key audit partner (external auditor). This includes negotiating the fee and scope of the audit, initiating a tender process, expressing an opinion regarding the appointment of an engagement partner and making formal recommendations to the Board on the appointment, reappointment and removal of the external auditors.

In April 2021, the Committee, after assessing the work of Grant Thornton, which is the Company's external auditor, and taking into account, inter alia, the opinion of the Finance Division, decided to propose to the Board of Directors the reappointment of the audit firm Grant Thornton as external auditor for the fiscal year 2021.

The Committee, following dialogue between the Company and the shareholders, has agreed to schedule discussions within the year 2022, among others including the Finance Division, in order to initiate preparatory work for the conduct of a tender for the selection of a new external auditor, in the context of the implementation of Regulation (EU) No 537/2014 of the European Parliament and of the Council of 16 April 2014 and the relevant transitional provisions of article 52 of Law 4449/2017 regarding the specific requirements for the statutory audit of public-interest entities.

Safeguarding independence and objectivity, and maintaining effectiveness

In its relationship with the external auditors, the Committee needs to ensure that they retain their independence and objectivity and are effective in performing the statutory audit. Both the Board and the external auditor have policies and procedures designed to protect the independence and objectivity of the external auditor.

The Committee considers the external auditors’ annual declaration of independence and discusses with them threats, that may threaten their independence, as well as ways to ensure that these threats are addressed. The Committee examined whether the relationships, considering the views of the external auditor, of the Management and of the internal audit, as appropriate, appear to affect the auditor's independence and objectivity.

In 2021, the external auditors submitted to the Committee the declaration of their independence from the Company in accordance with the Code of Ethics for Professional Accountants of the International Ethics Standards Board for Accountants (IESBA Code) and the ethical requirements related to the audit of the financial statements in Greece.

Financial Statements

The Committee has devoted a significant amount of time during its meetings in order to be informed and to discuss the process for the preparation of the annual and semi-annual Financial Statements. Main matters and activities performed were as follows:

| Matter | Activity |

|---|---|

| Statutory Audit Planning | The External Auditors presented to the Committee a report, which, inter alia, reflected the plan of communication between the external auditors and the Committee in relation to the timing of the statutory audit, of the separate and consolidated statements of the Company and its subsidiaries for the financial year 31.12.2021, the audit teams and specialists, as well as a reference to the key audit matters during the audit planning and in particular to the identified risks of the financial statements. |

| Audit of Annual Financial Statements — Key Audit Matters | The Committee monitored the audit of the Company’s annual financial statements for the financial year ended 31.12.2021 by the external auditors. The external auditors commented, inter alia, on the determination of materiality and discussed with the Committee on the methodology and parameters for its determination. More specifically, the external auditors informed the Committee that for the calculation of materiality, the Earnings Before Tax has been defined as an appropriate benchmark, given that the Company is listed on the Athens Stock Exchange In the discussions with the external auditors, particular emphasis was placed on the "Key Audit Matters" as identified by the external auditors, and how they these were treated during the audit.

The Committee examined and discussed in detail the above issues with the external auditors, without the presence of executives of the Company’s Finance Division. |

| Report of the Audit Committee to the Board of Directors on the Financial Statements 2020 | The Committee, following the review of the Financial Statements of the parent company and the Group for the year ended 31st December 2020 and the discussions held with the Finance Division and the external auditors, proposed their approval to the Board. |

| Tax Audit | The external auditors, in a meeting with the Committee without the presence of executives of the Company’s Finance Division, informed the members of the Committee about:

|

| Review of Interim Financial Statements | The external auditors informed, through a relevant report/ presentation, the Committee on their review of the Interim Financial Statements for the first half of 2021 carried out in accordance with ISA. The auditors referred, inter alia, to the scope and areas, as well as their procedures for the review of the Group, the determination of materiality, unrecorded misstatements and the key issues of their review. |

| Additional Report to the Audit Committee for 2021 | The External Auditors submitted and presented to the Committee their additional report, as provided by article 11 of EU Regulation 537/2014 on their audit of the Company and Group Financial Statements for the year ended 31 December 2021 |

| Additional Report to the Audit Committee for 2020 | The External Auditors submitted and presented to the Committee their additional report, as provided by article 11 of EU Regulation 537/2014 on their audit of the Company and Group Financial Statements for the year ended 31 December 2020 |

Use of the external auditors for non-audit services

The Committee monitors the external auditors’ compliance with the provisions of Regulation (EU) No 537/ 2014, as in force, regarding the level of the total fees paid by the Company to them in proportion to the overall fee income of the external auditors or their overall fee income from audit services, as well as other related regulatory requirements, so that the external auditors’ independence and objectivity is not impaired by the amount of work provided to the Company

The Committee is responsible for approving non-audit services to the Group entities that are not prohibited by law. The Committee considers that the external auditors have significant knowledge of the Group’s business and of how accounting policies are applied. That means it is sometimes cost-efficient for them to provide non-audit services. There may also be confidentiality reasons that make the external auditors the preferred choice for a particular non audit assignment.

However, safeguarding the external auditors’ objectivity and independence is an overriding priority. For this reason, the Committee ensures that the provision of such services does not impair the external auditors’ independence or objectivity.

In the context of non-audit services, whose provision by the Statutory Auditor is not prohibited by law, the Committee should apply judgement on and assess the following:

- threats to independence and objectivity resulting from the provision of such services and any safeguards in place to eliminate or reduce these threats to a level where they would not compromise the auditors’ independence and objectivity,

- the nature of the non-audit services,

- whether the skills and experience of the audit firm make it the most suitable supplier of the non-audit services,

- the fees incurred, or to be incurred, for non-audit services both for individual services and in aggregate, relative to the audit fee, including special terms and conditions (for example contingent fee arrangements), and

- the criteria which govern the compensation of the individuals performing the audit.

During 2021, the Committee examined the non-audit services that were proposed to be performed by the external auditor for the Company or subsidiaries of the Group, where the Committee, after evaluating the nature of proposed services and receiving relevant clarifications, declarations and assurance from the external auditor, considered that they did not pose a threat to the external auditor's independence in accordance with the provisions of article 44 of Law 4449/2017 and article 5 of Regulation (EU) 537/2014. The relevant non-audit services concerned pre-agreed procedures (a) in relation to the preparation of the financial statements (including the Explanatory Notes), which would concern fund agreements, calculations, drafts, data collection, analysis and related processing thereof, with the note that these analysis would be based on an approved trial balance by each Management function, as well as that the adjustment entries would be subject to the approval of the each Management function of the subsidiaries, (b) in the context of supporting the respective Management function for the technical implementation of the conversion processes to IFRS, c) on the calculation of financial indicators of the Company and its subsidiaries in the context of their compliance with the requirements of loan agreements with the creditors (banks), (d) regarding the proper compilation of the company's financial statements per activity / sector, in accordance with the provisions of Law 4001/2001, (d) for the audit of the 2020 Remuneration Report of the Company, (e) on each Flash Report and Trading Update of the Company, (f) for the issuance of a comfort letter and bring down letter in the context of the issuance of bonds by the Company, negotiable in the Luxembourg Euro MFT Market, (g) for the issuance of assurance reports in the context of the examination of the implementation of the financial scope of the Company's investment plans and its subsidiaries that have been subject to the provisions of Law 4399/2016, and (h) on the financial data for the table "CONSTRUCTION EXPERIENCE AND COMPETENCE DATA " in the context of the Company's participation in public tenders.

Neither the work done, nor the fees payable of the assigned non audit services, compromised the independence or objectivity of our external auditors.

Internal Audit

In monitoring the activity, role and effectiveness of the Internal Audit Division (IAD) and its audit program, the Committee had frequent meetings with the Internal Audit Director. The main matters examined through 2021 related to the following:

| Matter | Activity |

|---|---|

| Internal Audit Results | The Committee was informed by the Internal Audit Division regarding the audits performed and the reports issued during 2021. The Committee considered the major findings of the internal audits, as well as Management’s response. |

| Internal Audit Plan 2022 | The Committee was informed by the Internal Audit Division about the progress of the preparation of the audit plan for the year 2022. |

| Internal Audit Coverage | The Committee monitored the progress of internal audit assignments performed by the Internal Audit Division, which related to the coverage of key risk areas, based on the risk based Internal Audit Plan 2021. |

| Annual Evaluation of the Internal Audit Director | The Committee, within the 2nd quarter of 2021 finalized the evaluation of the Internal Audit Division’s Director. |

| Succession Plan of the Internal Audit Director | The Committee, in the context of the implementation of best practices and considering the needs of the Company and the market conditions, discussed the succession planning process of the Internal Audit Director |

Internal Control System

Specific related matters that the Committee considered for the year 2021 included the following activities:

| Matter | Activity |

|---|---|

| Financial Risks | The Committee was informed by the Finance Division and the Risk Management Division regarding the management of financial risks. |

| ESG Risks | The Committee was informed by the Corporate Governance and Sustainability General Division regarding the main ESG risk categories and the role of the Sustainability Division in ESG risk management and mitigation. |

| Project for the assessment of the adequacy of the procedures of central and support function within the COSO 2013 framework | The Committee was informed about the progress of the project "Assessment of the adequacy of the processes of central and support functions within the framework of COSO 2013 Internal Control System" by the Management, as well as by the external consultant to whom the relevant project has been assigned. |

| Information Systems Security | The Committee discussed with the Information Technology Division about the security of the IT systems. A presentation for the topic of "Cyber Security — Global threat landscape and MYTILINEOS perspective was performed. |

| Evaluation of the internal control procedures over financial reporting of the Company and the Group by the External Auditors | The external auditors presented to the Committee their report for the evaluation of the internal control procedures over financial reporting of the Company and the Group based on their audit for the year 2020 (Management letter). |

| Regulatory Compliance | The Committee was informed by the Compliance Division on the work, results and planning of its activities. |

Other Significant Matters

| Matter | Activity |

|---|---|

| Management Information System (MIS) | The Committee was informed on MIS matters by the Finance Division. |

| Infrastructure Projects | The Committee was informed on infrastructure projects by the Infrastructure Segment of the Sustainable Engineering Solutions (SES) Business Unit. |

| European climate goals & Sustainable Finance | The Committee was informed by the European Affairs Division on the following issues:

|

| Annual work plan for 2022 | The Committee approved its annual work plan for the year 2022. |

| Reports to the Board of Directors | The Committee prepared and submitted reports on its activities to the Board of Directors for the year ended 31 December 2020, and for the quarters ended 31 December 2020, 31 March 2021, 30 June 2021, and September 30, 2021. |

| Annual Report on the activities of the Audit Committee for the year ended 2020 | The Committee submitted its Annual Report on its activities for the year ended 2020 to the General Assembly of the Shareholders of 15th June 2021. |

The Committee expressed its satisfaction for the above information and the progress of the relevant work/projects in progress.

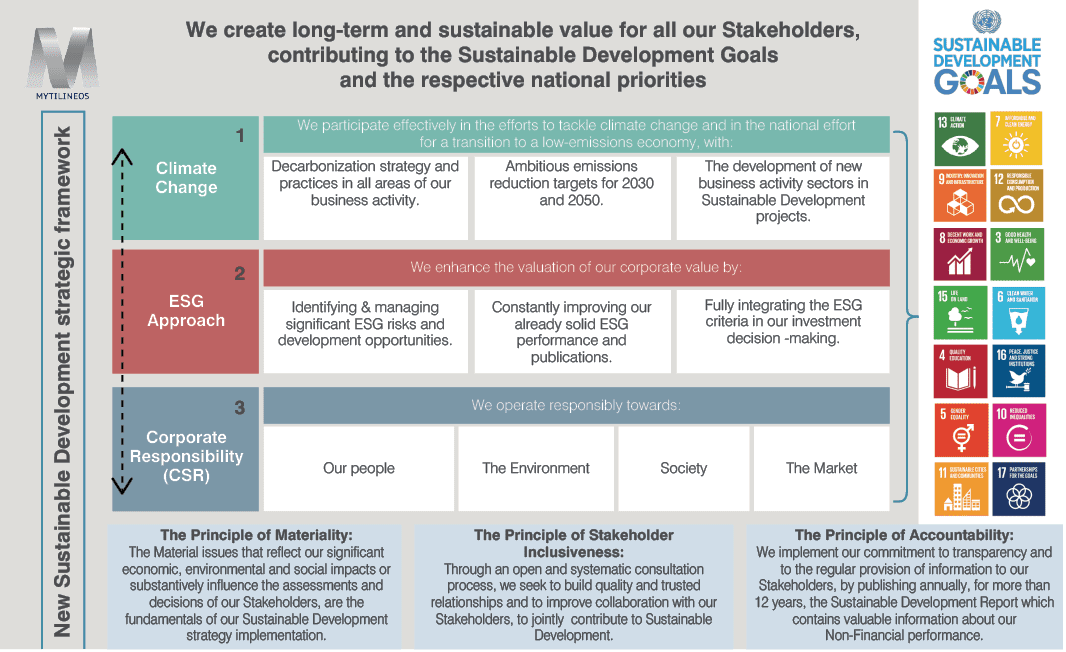

Sustainable Development Strategy

Sustainable Development is an integral part of the "corporate DNA" of MYTILINEOS and, therefore of its long-term business strategy. It is the driving force through which the Company aspires to remain competitive in the long term, to meet contemporary challenges and, by developing appropriate partnerships, to contribute to a new and efficient model of socially inclusive growth, as it is reflected in the Sustainable Development Goals.

The Sustainable Development strategy aims at creating long-term and sustainable value for its shareholders and other Stakeholder groups, through a holistic approach that combines economic stability with social and environmental Sustainability. It is implemented on three basic levels that are inseparable from one another and is governed by specific Principles that ensure completeness (Materiality Principle), quality (Stakeholder Inclusiveness Principle) and transparency (Accountability Principle) across all its activities.

More specifically:

The first level focuses on the Company's commitment to adapting to and tackling climate change as well as its contribution to a new low-emissions economy. MYTILINEOS was the first Greek industrial company to set specific, measurable and ambitious targets for reducing CO2 emissions by 2030 and achieve carbon neutrality by 2050, thus setting carbon footprint reduction as a priority in its new Sustainable Development strategy. In addition, the creation of new Business Units of the Company oriented towards the dynamic development of sustainable development projects internationally (Renewables & Storage Development BU, and Sustainable Engineering Solutions BU) is predicted to play, in the coming years, a significant role in the energy transition and in the reduction of greenhouse gas emissions globally, giving MYTILINEOS the opportunity to scale up its positive impact and become one of the leading companies in the global market in this area.

The second level highlights MYTILINEOS’ systematic approach to the monitoring, optimal management, and disclosure of information about ESG risks and opportunities that affect its performance and its efforts to implement its strategy. The alignment of the Company with ESG criteria, that are primarily relevant to its activity, strengthens its ability to create long-term value and manage significant changes in the environment in which it operates. In this way, MYTILINEOS responds to the current sustainability requirements of investors, capital markets and financial institutions, as well as to society’s expectations of commitment and transparency regarding these issues, which are becoming more intense.

The third level expresses the responsible operation of MYTILINEOS, which has been systematically cultivated over the last 13 years through the implementation of its Corporate Social Responsibility (CSR) policy and the Company’s commitment to the 10 Principles of the UN Global Compact. For MYTILINEOS, CSR is an ongoing self-improvement and incessant learning process, while it also serves as a key mechanism for renewing its "social" license to operate and, at the same time, improves its competitiveness at national and international level.

MYTILINEOS, as a member of the United Nations Global Compact (Global Compact), has focused its strategy on the 17 Global Sustainable Development Goals (Agenda 2030), thus expressing its commitment to contribute, to the appropriate extent, to their implementation. The Global Goals are used as a common basis for dialogue and cooperation of MYTILINEOS with its main Social Partner groups and define the basic commitments of the Company until 2030.

The main commitments of MYTILINEOS:

- The consistent implementation of the new ambitious decarbonization plan of its activities, helping to maintain the rise of the average global temperature well below 2°C compared to the levels of the pre-industrial era.

- The further adaptation of its activity to the consequences of climate change by analyzing the relevant risks, while taking advantage of the relevant opportunities.

- The continuous commitment to its goal of ensuring a healthy and safe work environment without accidents, focusing on prevention.

- The continuation of its operation with a sense of responsibility and consistency towards its people, remaining their first choice throughout their professional career, while investing in their education and skills development.

- Ensuring respect for and protection of human rights and creating a working environment without discrimination and exclusion.

- Ensuring the further reduction of its environmental footprint through proper management and limitation of environmental impacts, in terms of water and energy use, protection of local biodiversity and waste management.

- The communication of the principles of Sustainable Development and Responsible Entrepreneurship to its main suppliers and partners.

- The consistent implementation of its social policy with actions and initiatives that strengthen the harmony of coexistence with its local communities and the wider society.

In addition, these commitments define responsible business behavior in general and the management of the environment, society and governance (ESG) topics on behalf of each MYTILINEOS Business Unit and subsidiary, with the aim of strengthening their capacity to generate long-term and sustainable value.

Marousi, 22.02.2022

The Audit Committee

Alexios Pilavios

Konstantina Mavraki

Anthony Bartzokas

Appendix — Audit Committee Members CVs

Alexios Pilavios

Non-Executive Director — Independent

Mr. Alexios Pilavios is currently Non-Executive Chair of Alpha Asset Management and Vice Chair of ABC Factoring of Alpha Bank Group. He is also non-executive Chair of the Athens Stock Exchange (ASE) and non-executive Director in the Boards of ATHEXClear and ATHEXCSD (Greek Central Securities Depository SA). Finally he is an independent non-executive Director of Plaisio and Trade Estates real estate investment company.

He has a deep experience in the fields of Banking, Asset Management and Capital Markets

During his thirty-five-year career, he held senior positions in the Greek financial sector. He was Chair of the Hellenic Capital Markets Commission (2004-2009) and General Manager of Alpha Bank (Head of Wealth Management) and member of the Executive Committee (2009-2017). During his tenure at Alpha Bank he has served as the CEO of Alpha Asset Management AEDAK, Chair of Alpha Finance SA, CEO of Alpha Investments SA and a member of the Board of Directors of Alpha Bank London.

During 1996-2000 he also held the position of Chair of the Association of Greek Institutional Investors.

Prior to his assignments with Alpha Bank he held senior positions with Ergo Bank, Commercial Bank of Greece and the National Investment Bank of Industrial Development (NIBID), and served also as a Director in their Subsidiaries Board of Directors.

Born in 1953, Alexios graduated from the Athens College and holds a BSc (Econ) from the London School of Economics, a MSc in Economics from the University of Essex and a PhD in the Economics of Education from the London University Institute of Education.

Tina (Konstantina) Mavraki

Non-Executive Director — Independent

Tina (Konstantina) Mavraki is a C-Level Executive with extensive global experience in capital markets, company and project funding, risk management and audit. She started her career in 1998 and lives in London.

She has held senior positions with global institutions including Morgan Stanley, Citigroup and Noble Group, where she was responsible for multi-million US$ financial and physical commodity investments in developed and emerging markets.

She has extensive financial and operational internal audit and due diligence experience, most notably as Office of CEO of US$ 1.4 billion fund Barak Fund Management Limited, and as Head of Financing of commodities Division of US$ 1.75 billion fund Gemcorp Capital LLP. She is a devoted sustainability professional, with deep expertise in governance and environmental impact.

Born in 1977 in Athens, Tina received an MA and BA in Philosophy, Politics & Economics from Oxford University and an MSc in Finance from London Business School. She is a CFA Charter- holder and holds a Certificate in Company Direction from the UK Institute of Directors.

Tina also founded UK Charity Hellenic Hope, making a lasting impact on thousands of children at risk in Greece.

Anthony Μ. Bartzokas

Non-Executive Director — Independent

Mr. Bartzokas is an associate Professor at the University of Athens and Visiting Professor in Practice at the London School of Economics and Political Science. He has extensive experience in the oversight of financial reporting and internal controls as he has been Chair of the Audit Committee, Board Member, and Member of the Retirement Plan Investment Committee at the European Bank for Reconstruction and Development (EBRD).

During his 9-year tenure at the EBRD, he also served as Chair of the European Union coordination group and was involved in all high-level decision-making processes, from country strategies to investment projects, including the approval and the modalities of EBRD’s engagement in Greece. He has worked on financial systems, corporate investment, and innovation dynamics with financial support from international institutions and continuous interaction with Multilateral Development Banks, the European Union and UN agencies. In his role as knowledge manager, he has coordinated international research teams and benefitted from the interaction with policymakers and the business community, especially when it comes to project structuring and the evolving dynamics of capital markets and innovation. During his tenure, EBRD investments in Greece reached record levels with 4,360 million euro in 67 projects and a pipeline of 890 million euro in 19 projects. Mr. Bartzokas was born in 1962.

Costas (Constantine) Cotsilinis

Non Board Member -Advisor to the Audit Committee

Costa Cotsilinis commenced his professional career in 1968 at Coopers & Lybrand, Wellington and transferred to the London office in 1972 and later that year to the Greek office. From 1978 to 2003 he was head of the audit practice of Coopers & Lybrand/PwC Greece and in the later years served as Chair of the Board. He retired from PwC in 2003.

He has served on various boards and committees including the Supervisory Board of the European Financial Reporting Advisory Group (2002-2004) and the Accounting Harmonization Committee of UNICE (2002-2005). From 2009 to 2014 he was Deputy Chair of the Hellenic Accounting and Auditing Standards Oversight Board and Chair of the Auditing Standards Board and represented Greece during that period in the relevant committees of the European Commission including Chair of the Auditing Working Group during the Greek Presidency.

Since 2006 he is Chair of the Board of a Greek subsidiary of an Israel Insurance Company, Deputy Chair of the Board of the charitable organisation, "The Smile of the Child" and he also acts as advisor to the Audit Committee of the National Bank of Greece. Since 1991 he is the Honorary Consul-General for New Zealand in Greece and has been twice honoured by Queen Elizabeth for his services.

He was born in New Zealand in 1946, was educated at Victoria University of Wellington and graduated with a Bachelor of Commerce and Administration degree. He is a Chartered Accountant: 1969 — 2012, Member of the New Zealand Institute of Chartered Accountants and 1993 — present Member of the Institute of Certified Public Accountants of Greece. He has dual New Zealand and Greek citizenship and is fluent in both Greek and English.

Vassiliki Prantzou

Audit Committee Secretary

Vassiliki Prantzou was born in 1981 in Athens. She is a graduate of the Law School of the Aristotle University of Thessaloniki and holds a postgraduate degree (Private Law A) from the School of Law of the National and Kapodistrian University of Athens. She is an accredited intermediary and has also attended a postgraduate course in business administration for executives (e-mba) at the University of Piraeus.

She is a member of the Athens Bar Association since 2006 and has joined the Company’s Legal Department in 2014.